A Glimpse Into The Expert Outlook On Westrock Coffee Through 4 Analysts

4 analysts have shared their evaluations of Westrock Coffee (NASDAQ:WEST) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

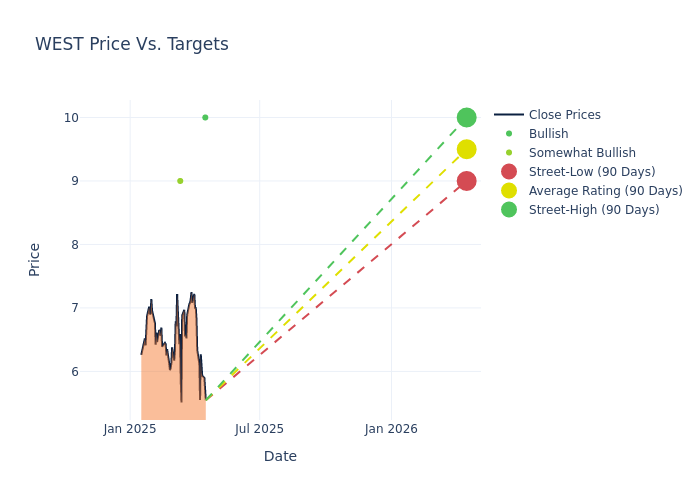

Insights from analysts' 12-month price targets are revealed, presenting an average target of $9.5, a high estimate of $10.00, and a low estimate of $9.00. A decline of 2.56% from the prior average price target is evident in the current average.

Decoding Analyst Ratings: A Detailed Look

The standing of Westrock Coffee among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|---------------------|---------------|---------------|--------------------|--------------------| |Todd Brooks |Benchmark |Maintains |Buy | $10.00|$10.00 | |Todd Brooks |Benchmark |Maintains |Buy | $10.00|$10.00 | |Sarang Vora |Telsey Advisory Group|Maintains |Outperform | $9.00|$9.00 | |Sarang Vora |Telsey Advisory Group|Lowers |Outperform | $9.00|$10.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Westrock Coffee. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Westrock Coffee compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Westrock Coffee's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Westrock Coffee's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Westrock Coffee analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know Westrock Coffee Better

Westrock Coffee Co is an integrated coffee, tea, flavors, extracts, and ingredients solutions provider in the U.S, providing coffee sourcing, supply chain management, product development, roasting, packaging, and distribution services to retail, foodservice and restaurant, convenience store and travel center, non-commercial account, CPG, and hospitality industries around the world. The company's segment includes Beverage Solutions and Sustainable Sourcing and Traceability. It generates maximum revenue from the Beverage Solutions segment.

Westrock Coffee: Financial Performance Dissected

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Over the 3M period, Westrock Coffee showcased positive performance, achieving a revenue growth rate of 6.52% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Staples sector.

Net Margin: Westrock Coffee's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -10.71%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -23.6%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Westrock Coffee's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -2.25%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Westrock Coffee's debt-to-equity ratio stands notably higher than the industry average, reaching 5.18. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.