Deep Dive Into Blackstone Mortgage Trust Stock: Analyst Perspectives (8 Ratings)

8 analysts have expressed a variety of opinions on Blackstone Mortgage Trust (NYSE:BXMT) over the past quarter, offering a diverse set of opinions from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 8 | 0 | 0 |

| Last 30D | 0 | 0 | 2 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

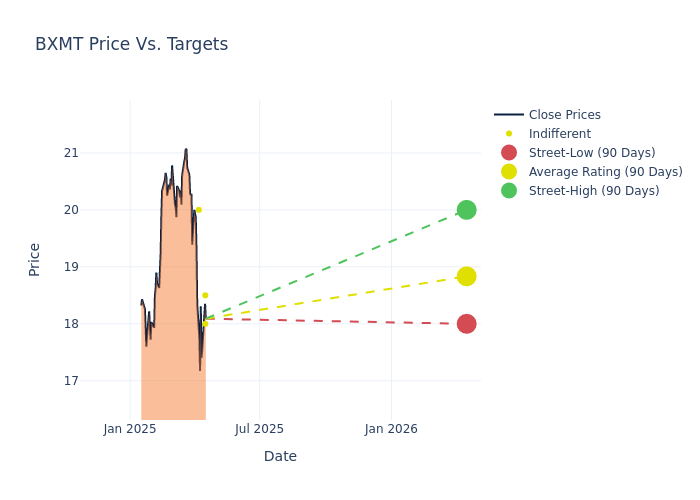

Analysts have set 12-month price targets for Blackstone Mortgage Trust, revealing an average target of $19.19, a high estimate of $20.50, and a low estimate of $17.50. Observing a 0.68% increase, the current average has risen from the previous average price target of $19.06.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Blackstone Mortgage Trust among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|-----------------------|---------------|---------------|--------------------|--------------------| |Douglas Harter |UBS |Lowers |Neutral | $18.00|$19.50 | |Richard Shane |JP Morgan |Lowers |Neutral | $18.50|$20.00 | |Jade Rahmani |Keefe, Bruyette & Woods|Lowers |Market Perform | $20.00|$20.50 | |Jade Rahmani |Keefe, Bruyette & Woods|Raises |Market Perform | $20.50|$19.50 | |Douglas Harter |UBS |Raises |Neutral | $19.50|$18.50 | |Richard Shane |JP Morgan |Raises |Neutral | $20.00|$17.50 | |Jade Rahmani |Keefe, Bruyette & Woods|Raises |Market Perform | $19.50|$18.50 | |Richard Shane |JP Morgan |Lowers |Neutral | $17.50|$18.50 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Blackstone Mortgage Trust. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Blackstone Mortgage Trust compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Blackstone Mortgage Trust's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into Blackstone Mortgage Trust's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Blackstone Mortgage Trust analyst ratings.

Delving into Blackstone Mortgage Trust's Background

Blackstone Mortgage Trust Inc is a real estate finance company involved in the origination and purchase of senior loans collateralized by commercial properties in North America, Europe, and Australia. The vast majority of the company's asset portfolio is comprised of floating rate loans secured by priority mortgages. These mortgages are mainly derived from office, hotel, and manufactured housing properties. A percentage of the collateralized real estate properties are located in New York, California, and the United Kingdom. Blackstone Mortgage Trust is managed by a subsidiary of The Blackstone Group and benefits from the market data provided by its parent company. Nearly all of Blackstone Mortgage Trust's revenue is generated in the form of interest income.

Blackstone Mortgage Trust: A Financial Overview

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Challenges: Blackstone Mortgage Trust's revenue growth over 3M faced difficulties. As of 31 December, 2024, the company experienced a decline of approximately -25.57%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: Blackstone Mortgage Trust's net margin is impressive, surpassing industry averages. With a net margin of 32.5%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Blackstone Mortgage Trust's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 0.97%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Blackstone Mortgage Trust's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.18% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Blackstone Mortgage Trust's debt-to-equity ratio surpasses industry norms, standing at 4.15. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Core of Analyst Ratings: What Every Investor Should Know

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.