Deep Dive Into Analog Devices Stock: Analyst Perspectives (11 Ratings)

11 analysts have shared their evaluations of Analog Devices (NASDAQ:ADI) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 3 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 3 | 2 | 0 | 0 |

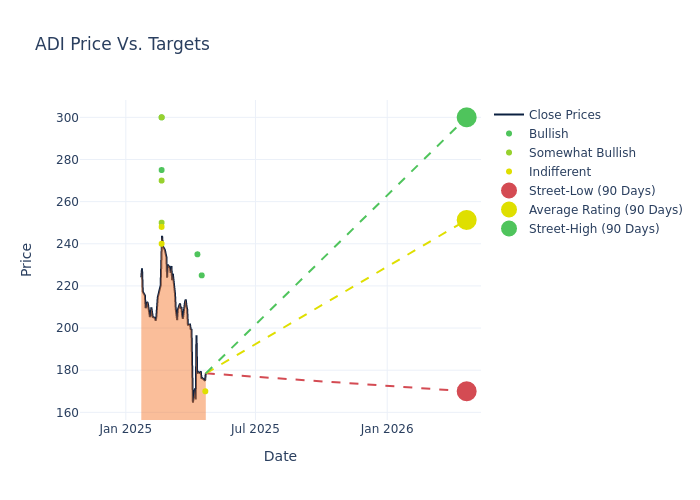

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $250.73, along with a high estimate of $300.00 and a low estimate of $170.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 0.62%.

Interpreting Analyst Ratings: A Closer Look

A clear picture of Analog Devices's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Tom O'Malley |Barclays |Lowers |Equal-Weight | $170.00|$240.00 | |Tore Svanberg |Stifel |Lowers |Buy | $225.00|$275.00 | |Christopher Danely |Citigroup |Lowers |Buy | $235.00|$265.00 | |Rick Schafer |Oppenheimer |Raises |Outperform | $270.00|$245.00 | |William Stein |Truist Securities |Raises |Hold | $248.00|$230.00 | |Harlan Sur |JP Morgan |Raises |Overweight | $300.00|$280.00 | |Timothy Arcuri |UBS |Raises |Buy | $300.00|$275.00 | |Joe Quatrochi |Wells Fargo |Raises |Equal-Weight | $240.00|$220.00 | |Joseph Moore |Morgan Stanley |Raises |Overweight | $250.00|$248.00 | |David Williams |Benchmark |Raises |Buy | $275.00|$245.00 | |David Williams |Benchmark |Announces |Buy | $245.00|- |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Analog Devices. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Analog Devices compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Analog Devices's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Analog Devices's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Analog Devices analyst ratings.

Discovering Analog Devices: A Closer Look

Analog Devices is a leading analog, mixed-signal, and digital-signal processing chipmaker. The firm has a significant market share lead in converter chips, which are used to translate analog signals to digital and vice versa. The company serves tens of thousands of customers; more than half of its chip sales are to industrial and automotive end markets. ADI's chips are also incorporated into wireless infrastructure equipment.

Understanding the Numbers: Analog Devices's Finances

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, Analog Devices faced challenges, resulting in a decline of approximately -3.56% in revenue growth as of 31 January, 2025. This signifies a reduction in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Analog Devices's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 16.15%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Analog Devices's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 1.11%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.81%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Analog Devices's debt-to-equity ratio is below the industry average. With a ratio of 0.22, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.