Expert Outlook: Cadence Design Systems Through The Eyes Of 9 Analysts

Analysts' ratings for Cadence Design Systems (NASDAQ:CDNS) over the last quarter vary from bullish to bearish, as provided by 9 analysts.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 4 | 1 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 1 | 0 |

| 3M Ago | 3 | 2 | 1 | 0 | 0 |

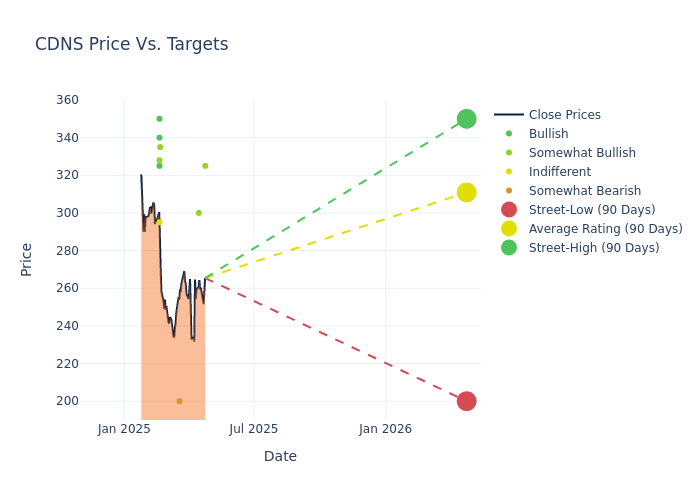

In the assessment of 12-month price targets, analysts unveil insights for Cadence Design Systems, presenting an average target of $310.89, a high estimate of $350.00, and a low estimate of $200.00. Highlighting a 2.27% decrease, the current average has fallen from the previous average price target of $318.11.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of Cadence Design Systems among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Harlan Sur |JP Morgan |Raises |Overweight | $325.00|$300.00 | |Siti Panigrahi |Mizuho |Lowers |Outperform | $300.00|$350.00 | |Edward Yang |Oppenheimer |Lowers |Underperform | $200.00|$225.00 | |Joe Vruwink |Baird |Lowers |Outperform | $335.00|$340.00 | |Gary Mobley |Loop Capital |Lowers |Buy | $340.00|$360.00 | |Vivek Arya |B of A Securities |Lowers |Buy | $350.00|$365.00 | |Blair Abernethy |Rosenblatt |Raises |Neutral | $295.00|$280.00 | |Charles Shi |Needham |Maintains |Buy | $325.00|$325.00 | |Clarke Jeffries |Piper Sandler |Raises |Overweight | $328.00|$318.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Cadence Design Systems. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Cadence Design Systems compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Cadence Design Systems's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Cadence Design Systems's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Cadence Design Systems analyst ratings.

Get to Know Cadence Design Systems Better

Cadence Design Systems is a provider of electronic design automation software, intellectual property, and system design and analysis products. EDA software automates and aids in the chip design process, enhancing design accuracy, productivity, and complexity in a full-flow end-to-end solution. Cadence offers a portfolio of design IP, as well as system design and analysis products, which enables system-level analysis and verification solutions.

Understanding the Numbers: Cadence Design Systems's Finances

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Cadence Design Systems's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 26.89% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Cadence Design Systems's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 25.09% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Cadence Design Systems's ROE stands out, surpassing industry averages. With an impressive ROE of 7.37%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Cadence Design Systems's ROA stands out, surpassing industry averages. With an impressive ROA of 3.75%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Cadence Design Systems's debt-to-equity ratio stands notably higher than the industry average, reaching 0.55. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyst Ratings: What Are They?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.