Forecasting The Future: 5 Analyst Projections For American Public Education

In the latest quarter, 5 analysts provided ratings for American Public Education (NASDAQ:APEI), showcasing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

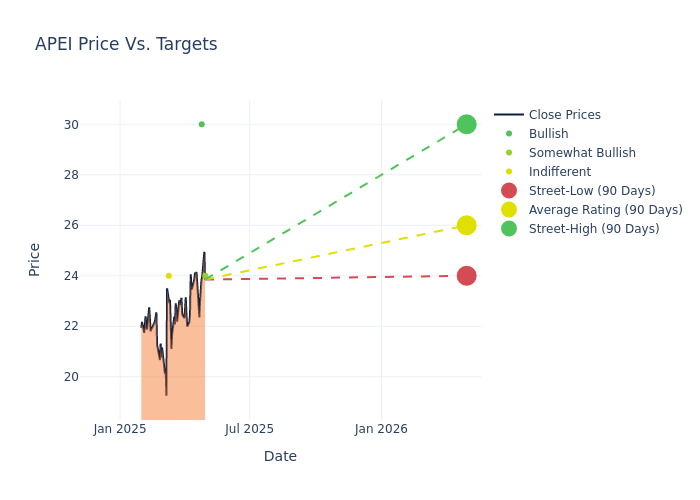

Analysts have recently evaluated American Public Education and provided 12-month price targets. The average target is $25.2, accompanied by a high estimate of $30.00 and a low estimate of $24.00. Marking an increase of 9.57%, the current average surpasses the previous average price target of $23.00.

Interpreting Analyst Ratings: A Closer Look

A comprehensive examination of how financial experts perceive American Public Education is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Alexander Paris | Barrington Research | Maintains | Outperform | $24.00 | $24.00 |

| Eric Martinuzzi | Lake Street | Announces | Buy | $30.00 | - |

| Jasper Bibb | Truist Securities | Raises | Hold | $24.00 | $20.00 |

| Alexander Paris | Barrington Research | Maintains | Outperform | $24.00 | $24.00 |

| Alexander Paris | Barrington Research | Maintains | Outperform | $24.00 | $24.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to American Public Education. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of American Public Education compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for American Public Education's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of American Public Education's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on American Public Education analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know American Public Education Better

American Public Education Inc provides online and campus based postsecondary education including various undergraduate and graduate degree programs. The fields of study include business administration, health science, technology, criminal justice, education, liberal arts, national security, military studies, intelligence, and homeland security. There are three reporting segments: the American Public University segment which is the key revenue generator; the Rasmussen University Segment and the Hondros College of Nursing segment. The revenue is generated from net course registrations and enrollment, tuition rate, net tuition, and other fees.

Financial Milestones: American Public Education's Journey

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: American Public Education's remarkable performance in 3M is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 7.4%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: American Public Education's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 7.01%, the company may face hurdles in effective cost management.

Return on Equity (ROE): American Public Education's ROE stands out, surpassing industry averages. With an impressive ROE of 4.47%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): American Public Education's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 2.02%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: American Public Education's debt-to-equity ratio stands notably higher than the industry average, reaching 0.76. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.