Demystifying Gates Industrial Corp: Insights From 11 Analyst Reviews

11 analysts have shared their evaluations of Gates Industrial Corp (NYSE:GTES) during the recent three months, expressing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 8 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 2 | 1 | 0 | 0 |

| 3M Ago | 0 | 3 | 1 | 0 | 0 |

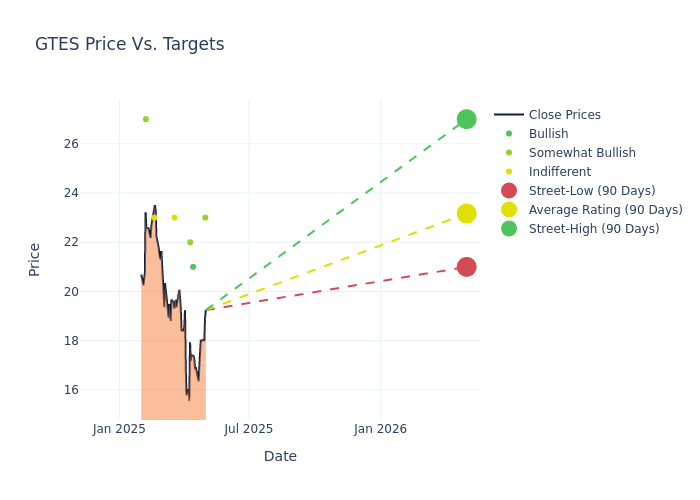

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $24.09, with a high estimate of $27.00 and a low estimate of $21.00. A decline of 3.29% from the prior average price target is evident in the current average.

Decoding Analyst Ratings: A Detailed Look

The standing of Gates Industrial Corp among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Justin Patterson | Keybanc | Raises | Overweight | $23.00 | $21.00 |

| Andrew Kaplowitz | Citigroup | Lowers | Buy | $21.00 | $27.00 |

| Julian Mitchell | Barclays | Lowers | Overweight | $22.00 | $25.00 |

| Jeffrey Hammond | Keybanc | Lowers | Overweight | $21.00 | $27.00 |

| Julian Mitchell | Barclays | Lowers | Overweight | $25.00 | $26.00 |

| Jerry Revich | Goldman Sachs | Lowers | Neutral | $23.00 | $26.00 |

| Julian Mitchell | Barclays | Lowers | Overweight | $26.00 | $27.00 |

| David Raso | Evercore ISI Group | Raises | In-Line | $23.00 | $22.00 |

| Julian Mitchell | Barclays | Raises | Overweight | $27.00 | $25.00 |

| Deane Dray | RBC Capital | Raises | Outperform | $27.00 | $25.00 |

| Jeffrey Hammond | Keybanc | Raises | Overweight | $27.00 | $23.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Gates Industrial Corp. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Gates Industrial Corp compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Gates Industrial Corp's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Gates Industrial Corp's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Gates Industrial Corp analyst ratings.

About Gates Industrial Corp

Gates Industrial Corp PLC is a manufacturer of engineered power transmission and fluid power solutions. The company has two operating segments; Power Transmission and Fluid Power segments. The Power Transmission solutions convey power and control motion. It is used in applications in which belts, chains, cables, geared transmissions, or direct drives transfer power from an engine or motor to another part or system. The Fluid power solutions are used in applications in which hoses and rigid tubing assemblies either transfer power hydraulically or convey fluids, gases, or granular materials from one location to another. The company generates key revenue from the Power Transmission segment. Company operates in USA, United Kingdom, Luxembourg, EMEA, with majority revenue from USA.

Gates Industrial Corp: Delving into Financials

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Gates Industrial Corp's revenue growth over a period of 3M has faced challenges. As of 31 December, 2024, the company experienced a revenue decline of approximately -3.93%. This indicates a decrease in the company's top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 4.41%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Gates Industrial Corp's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.19%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Gates Industrial Corp's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.53%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a high debt-to-equity ratio of 0.82, Gates Industrial Corp faces challenges in effectively managing its debt levels, indicating potential financial strain.

Understanding the Relevance of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.