American Homes 4 Rent Stock: A Deep Dive Into Analyst Perspectives (8 Ratings)

8 analysts have expressed a variety of opinions on American Homes 4 Rent (NYSE:AMH) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 6 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 3 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

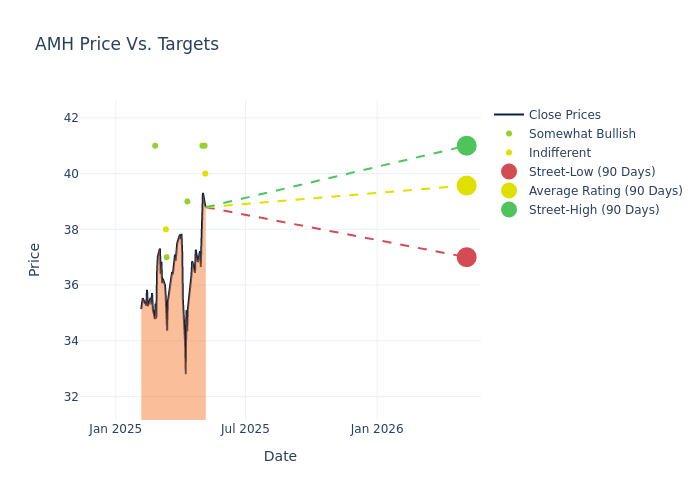

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $39.5, a high estimate of $41.00, and a low estimate of $37.00. This current average has decreased by 1.25% from the previous average price target of $40.00.

Breaking Down Analyst Ratings: A Detailed Examination

The analysis of recent analyst actions sheds light on the perception of American Homes 4 Rent by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jade Rahmani | Keefe, Bruyette & Woods | Raises | Market Perform | $40.00 | $38.00 |

| Brad Heffern | RBC Capital | Raises | Outperform | $41.00 | $39.00 |

| Steve Sakwa | Evercore ISI Group | Raises | Outperform | $41.00 | $40.00 |

| Buck Horne | Raymond James | Lowers | Outperform | $39.00 | $44.00 |

| Haendel St. Juste | Mizuho | Lowers | Outperform | $37.00 | $41.00 |

| Richard Hightower | Barclays | Raises | Equal-Weight | $38.00 | $37.00 |

| Aaron Hecht | Citizens Capital Markets | Maintains | Market Outperform | $41.00 | $41.00 |

| Brad Heffern | RBC Capital | Lowers | Outperform | $39.00 | $40.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to American Homes 4 Rent. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of American Homes 4 Rent compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of American Homes 4 Rent's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of American Homes 4 Rent's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on American Homes 4 Rent analyst ratings.

About American Homes 4 Rent

American Homes 4 Rent is a real estate investment trust focused on acquiring, operating, and leasing single-family homes as rental properties throughout the United States. The company's real estate portfolio is largely comprised of single-family properties in urban markets in the Southern and Midwestern regions of the U.S. American Homes 4 Rent's land holdings also represent a sizable percentage of its total assets in terms of value. The company derives the vast majority of its income in the form of rental revenue from single-family properties through short-term or annual leases. The firm's geographical markets include Dallas, Texas; Indianapolis, Indiana; Atlanta, Georgia; and Charlotte, North Carolina in terms of the number of properties in each.

American Homes 4 Rent: Delving into Financials

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: American Homes 4 Rent's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 8.43%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: American Homes 4 Rent's net margin is impressive, surpassing industry averages. With a net margin of 23.94%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): American Homes 4 Rent's ROE excels beyond industry benchmarks, reaching 1.54%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): American Homes 4 Rent's ROA stands out, surpassing industry averages. With an impressive ROA of 0.82%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: American Homes 4 Rent's debt-to-equity ratio is below the industry average. With a ratio of 0.69, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: What Are They?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.