Assessing Zimmer Biomet Holdings: Insights From 10 Financial Analysts

Ratings for Zimmer Biomet Holdings (NYSE:ZBH) were provided by 10 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 5 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 5 | 3 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

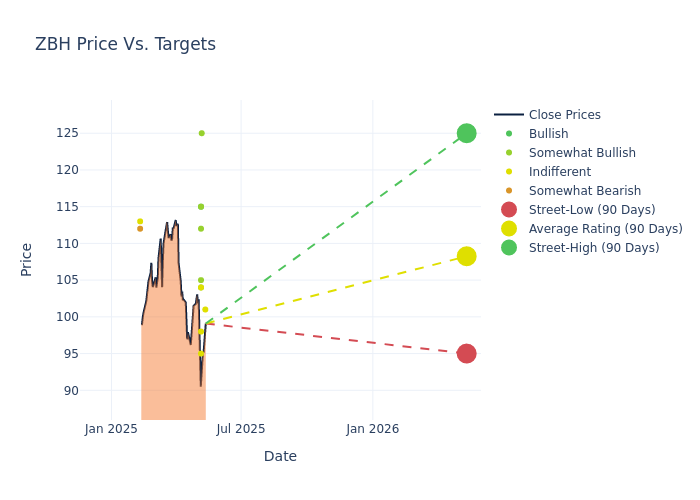

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $107.4, a high estimate of $125.00, and a low estimate of $95.00. A 13.6% drop is evident in the current average compared to the previous average price target of $124.30.

Understanding Analyst Ratings: A Comprehensive Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Zimmer Biomet Holdings. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| William Plovanic | Canaccord Genuity | Lowers | Hold | $101.00 | $115.00 |

| David Turkaly | JMP Securities | Lowers | Market Outperform | $125.00 | $140.00 |

| David Roman | Goldman Sachs | Lowers | Neutral | $104.00 | $120.00 |

| Jayson Bedford | Raymond James | Lowers | Outperform | $104.00 | $119.00 |

| Rick Wise | Stifel | Lowers | Buy | $115.00 | $138.00 |

| Shagun Singh | RBC Capital | Lowers | Outperform | $112.00 | $125.00 |

| Cecilia Furlong | Morgan Stanley | Lowers | Equal-Weight | $95.00 | $115.00 |

| Robbie Marcus | JP Morgan | Lowers | Overweight | $105.00 | $128.00 |

| Larry Biegelsen | Wells Fargo | Lowers | Equal-Weight | $98.00 | $113.00 |

| Jeff Johnson | Baird | Lowers | Outperform | $115.00 | $130.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Zimmer Biomet Holdings. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Zimmer Biomet Holdings compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Zimmer Biomet Holdings's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into Zimmer Biomet Holdings's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Zimmer Biomet Holdings analyst ratings.

All You Need to Know About Zimmer Biomet Holdings

Zimmer Biomet designs, manufactures, and markets orthopedic reconstructive implants as well as supplies and surgical equipment for orthopedic surgery. With the acquisitions of Centerpulse in 2003 and Biomet in 2015, Zimmer holds the leading share of the reconstructive market in the United States, Europe, and Japan. Roughly two thirds of total revenue is derived from sales of large joints; another fourth comes from extremities, trauma, sports medicine, and related surgical products. The firm spun out its dental and spine businesses in 2022.

Unraveling the Financial Story of Zimmer Biomet Holdings

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Positive Revenue Trend: Examining Zimmer Biomet Holdings's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1.05% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Zimmer Biomet Holdings's net margin is impressive, surpassing industry averages. With a net margin of 9.53%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Zimmer Biomet Holdings's ROE stands out, surpassing industry averages. With an impressive ROE of 1.46%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.84%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.58, Zimmer Biomet Holdings adopts a prudent financial strategy, indicating a balanced approach to debt management.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.