Breaking Down Dianthus Therapeutics: 5 Analysts Share Their Views

Across the recent three months, 5 analysts have shared their insights on Dianthus Therapeutics (NASDAQ:DNTH), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 2 | 0 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 1 | 0 | 0 | 0 |

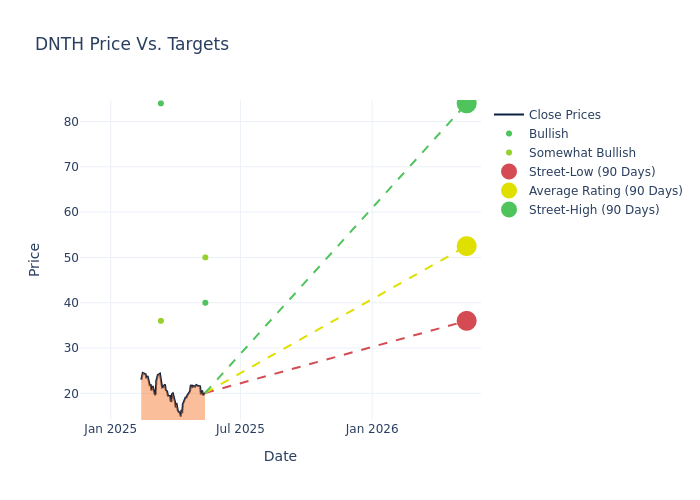

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $50.0, a high estimate of $84.00, and a low estimate of $36.00. This current average has decreased by 3.1% from the previous average price target of $51.60.

Diving into Analyst Ratings: An In-Depth Exploration

A comprehensive examination of how financial experts perceive Dianthus Therapeutics is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joel Beatty | Baird | Lowers | Outperform | $50.00 | $58.00 |

| Swayampakula Ramakanth | HC Wainwright & Co. | Maintains | Buy | $40.00 | $40.00 |

| Laura Chico | Wedbush | Maintains | Outperform | $36.00 | $36.00 |

| Yatin Suneja | Guggenheim | Maintains | Buy | $84.00 | $84.00 |

| Swayampakula Ramakanth | HC Wainwright & Co. | Maintains | Buy | $40.00 | $40.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Dianthus Therapeutics. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Dianthus Therapeutics compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Dianthus Therapeutics's stock. This analysis reveals shifts in analysts' expectations over time.

To gain a panoramic view of Dianthus Therapeutics's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Dianthus Therapeutics analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Dianthus Therapeutics: A Closer Look

Dianthus Therapeutics Inc is a clinical-stage biotechnology company dedicated to designing and delivering novel, monoclonal antibodies with improved selectivity and potency over existing complement therapies. The company is focused on developing next-generation complement therapeutics for patients living with severe autoimmune and inflammatory diseases. The company is comprised of an experienced team of biotech and pharma executives. The company's pipeline consists of DNTH103 a subcutaneous active C1s antibody.

Dianthus Therapeutics's Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Dianthus Therapeutics displayed positive results in 3M. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 190.15%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Dianthus Therapeutics's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -2144.8%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Dianthus Therapeutics's ROE excels beyond industry benchmarks, reaching -8.24%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -7.81%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Dianthus Therapeutics's debt-to-equity ratio is below the industry average at 0.0, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.