Insights Ahead: scPharmaceuticals's Quarterly Earnings

scPharmaceuticals (NASDAQ:SCPH) is gearing up to announce its quarterly earnings on Wednesday, 2025-05-14. Here's a quick overview of what investors should know before the release.

Analysts are estimating that scPharmaceuticals will report an earnings per share (EPS) of $-0.28.

Anticipation surrounds scPharmaceuticals's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

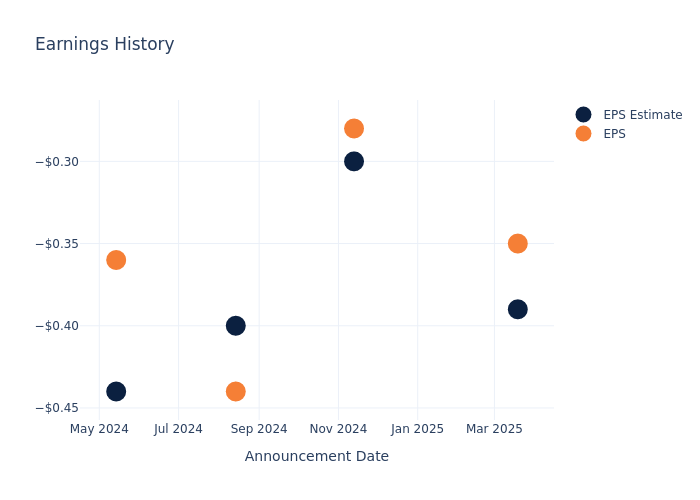

Earnings History Snapshot

The company's EPS beat by $0.04 in the last quarter, leading to a 0.99% drop in the share price on the following day.

Here's a look at scPharmaceuticals's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.39 | -0.30 | -0.40 | -0.44 |

| EPS Actual | -0.35 | -0.28 | -0.44 | -0.36 |

| Price Change % | -1.0% | -14.000000000000002% | 6.0% | 2.0% |

Tracking scPharmaceuticals's Stock Performance

Shares of scPharmaceuticals were trading at $2.48 as of May 12. Over the last 52-week period, shares are down 49.02%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Observations about scPharmaceuticals

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding scPharmaceuticals.

Analysts have given scPharmaceuticals a total of 4 ratings, with the consensus rating being Buy. The average one-year price target is $16.5, indicating a potential 565.32% upside.

Understanding Analyst Ratings Among Peers

This comparison focuses on the analyst ratings and average 1-year price targets of Nektar Therapeutics and Aclaris Therapeutics, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Nektar Therapeutics, with an average 1-year price target of $5.25, suggesting a potential 111.69% upside.

- Analysts currently favor an Outperform trajectory for Aclaris Therapeutics, with an average 1-year price target of $12.0, suggesting a potential 383.87% upside.

Overview of Peer Analysis

Within the peer analysis summary, vital metrics for Nektar Therapeutics and Aclaris Therapeutics are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| scPharmaceuticals | Buy | 99.31% | $8.19M | -85.60% |

| Nektar Therapeutics | Buy | 22.15% | $21.20M | 13.25% |

| Aclaris Therapeutics | Outperform | -47.58% | $-90K | -67.59% |

Key Takeaway:

scPharmaceuticals ranks highest in revenue growth among its peers. It has the lowest gross profit and return on equity compared to its peers.

All You Need to Know About scPharmaceuticals

scPharmaceuticals Inc is a pharmaceutical company focused on developing and commercializing products that have the potential to optimize the delivery of infused therapies, advance patient care, and reduce healthcare costs. The company's main product is Furoscix to treat congestion in patients with heart failure and edema in patients with chronic kidney disease. Furoscix is a novel formulation of furosemide contained in a pre-filled, Crystal Zenith cartridge and self-administered subcutaneously via a single-use, disposable, and wearable on-body delivery system.

scPharmaceuticals: Financial Performance Dissected

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: scPharmaceuticals displayed positive results in 3 months. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 99.31%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -155.1%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): scPharmaceuticals's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -85.6%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): scPharmaceuticals's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -16.2%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: scPharmaceuticals's debt-to-equity ratio stands notably higher than the industry average, reaching 3.96. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for scPharmaceuticals visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.