What 10 Analyst Ratings Have To Say About Revolve Gr

Providing a diverse range of perspectives from bullish to bearish, 10 analysts have published ratings on Revolve Gr (NYSE:RVLV) in the last three months.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 2 | 2 | 0 | 0 |

| 2M Ago | 1 | 1 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

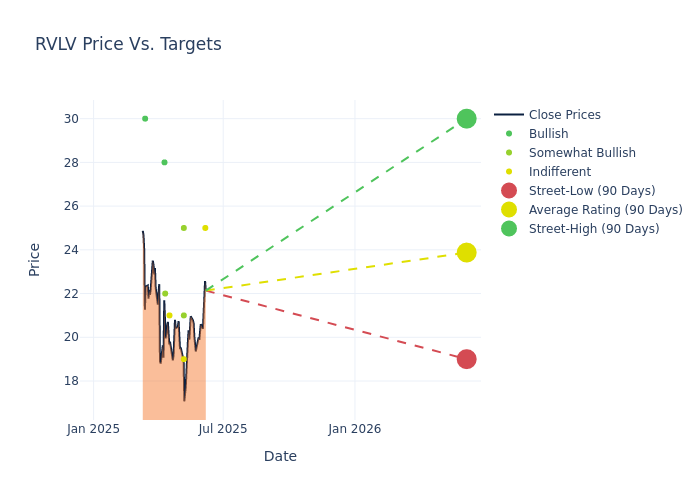

In the assessment of 12-month price targets, analysts unveil insights for Revolve Gr, presenting an average target of $23.9, a high estimate of $30.00, and a low estimate of $19.00. This current average has decreased by 17.9% from the previous average price target of $29.11.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of Revolve Gr by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mark Altschwager | Baird | Raises | Neutral | $25.00 | $23.00 |

| Mark Altschwager | Baird | Lowers | Neutral | $23.00 | $25.00 |

| Ashley Owens | Keybanc | Lowers | Overweight | $25.00 | $37.00 |

| Jay Sole | UBS | Lowers | Neutral | $19.00 | $22.00 |

| Rick Paterson | Raymond James | Lowers | Outperform | $21.00 | $25.00 |

| Mark Altschwager | Baird | Lowers | Neutral | $25.00 | $26.00 |

| Lauren Schenk | Morgan Stanley | Lowers | Equal-Weight | $21.00 | $29.00 |

| Anna Andreeva | Piper Sandler | Lowers | Overweight | $22.00 | $35.00 |

| Jim Duffy | Stifel | Lowers | Buy | $28.00 | $40.00 |

| Randal Konik | Jefferies | Announces | Buy | $30.00 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Revolve Gr. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Revolve Gr compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Revolve Gr's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Revolve Gr's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Revolve Gr analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Revolve Gr

The Revolve Group is an emerging e-commerce retailer, selling women's dresses, handbags, shoes, beauty products, and incidentals across its marketplace properties, Revolve and FWRD. The platform is built to suit the "next-generation customer," emphasizing mobile commerce, influencer marketing, and occupying an aspirational but attainable luxury niche. With $1.1 billion in 2024 net sales, the firm sits just outside the top 30 apparel retailers (by sales) in the US, but has consistently generated robust top-line growth as the industry continues to favor digital channels. Revolve generates approximately 18% of sales from private-label offerings, while focusing on building an inventory of unique products from emerging fashion brands with less than $10 million in annual sales.

Financial Milestones: Revolve Gr's Journey

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Revolve Gr's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 9.66%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Revolve Gr's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 3.98%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Revolve Gr's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.65%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Revolve Gr's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.71%, the company showcases efficient use of assets and strong financial health.

Debt Management: Revolve Gr's debt-to-equity ratio is below the industry average at 0.1, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.