A Glimpse Into The Expert Outlook On Crescent Energy Through 6 Analysts

Crescent Energy (NYSE:CRGY) underwent analysis by 6 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 1 | 0 | 0 |

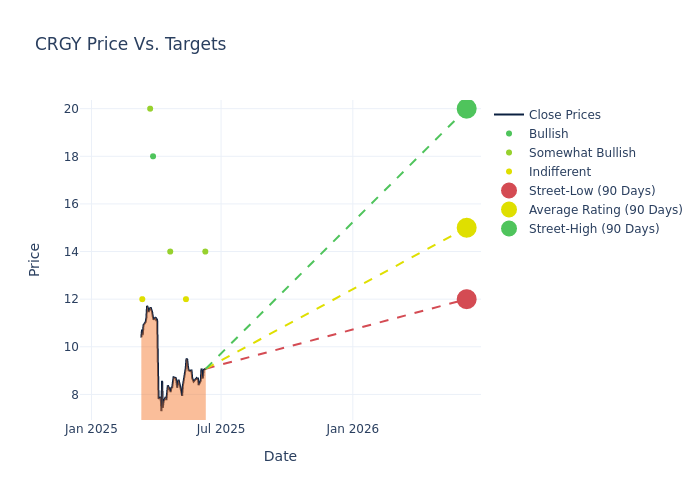

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $15.0, a high estimate of $20.00, and a low estimate of $12.00. This current average represents a 19.35% decrease from the previous average price target of $18.60.

Investigating Analyst Ratings: An Elaborate Study

A comprehensive examination of how financial experts perceive Crescent Energy is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mark Lear | Piper Sandler | Announces | Overweight | $14.00 | - |

| William Janela | Mizuho | Lowers | Neutral | $12.00 | $13.00 |

| Tim Rezvan | Keybanc | Lowers | Overweight | $14.00 | $18.00 |

| John Freeman | Raymond James | Lowers | Strong Buy | $18.00 | $23.00 |

| Roger Read | Wells Fargo | Lowers | Overweight | $20.00 | $21.00 |

| Arun Jayaram | JP Morgan | Lowers | Neutral | $12.00 | $18.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Crescent Energy. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Crescent Energy compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Crescent Energy's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Crescent Energy's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Crescent Energy analyst ratings.

Get to Know Crescent Energy Better

Crescent Energy Co is an independent energy company with a portfolio of assets in key basins across the lower 48 states. The company maintains a diverse portfolio of assets in key basins across the United States, including the Eagle Ford, Rockies, Barnett, Permian, and Mid-Con. It seeks to deliver attractive risk-adjusted investment returns and predictable cash flows across cycles with a focus on operated oil and gas assets complemented by non-operated assets, mineral and royalty interests, and midstream infrastructure.

Crescent Energy: Financial Performance Dissected

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Crescent Energy's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 44.52%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Energy sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Crescent Energy's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -0.23%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Crescent Energy's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -0.07%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Crescent Energy's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -0.02%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Crescent Energy's debt-to-equity ratio surpasses industry norms, standing at 1.13. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.