Analyst Expectations For Live Nation Entertainment's Future

Throughout the last three months, 6 analysts have evaluated Live Nation Entertainment (NYSE:LYV), offering a diverse set of opinions from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 2 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 1 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 0 | 0 | 0 |

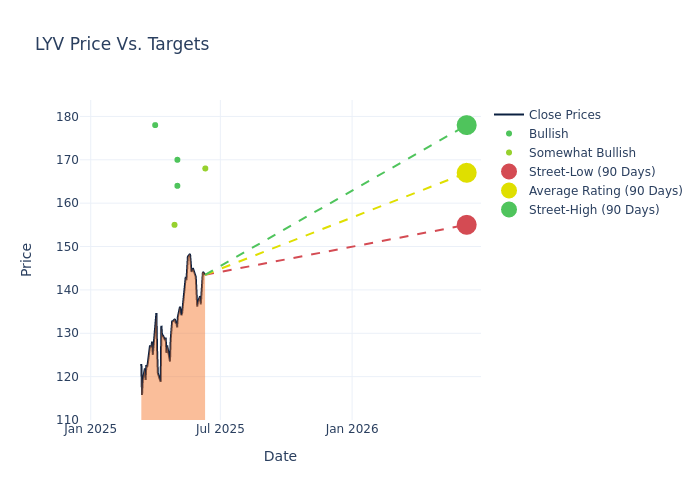

The 12-month price targets, analyzed by analysts, offer insights with an average target of $168.17, a high estimate of $178.00, and a low estimate of $155.00. A 2.23% drop is evident in the current average compared to the previous average price target of $172.00.

Decoding Analyst Ratings: A Detailed Look

A clear picture of Live Nation Entertainment's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| John Janedis | Wolfe Research | Raises | Outperform | $168.00 | $160.00 |

| Eric Handler | Roth MKM | Lowers | Buy | $164.00 | $174.00 |

| Barton Crockett | Rosenblatt | Lowers | Buy | $170.00 | $174.00 |

| Joseph Stauff | Susquehanna | Announces | Positive | $155.00 | - |

| Matthew Harrigan | Benchmark | Maintains | Buy | $178.00 | $178.00 |

| Barton Crockett | Rosenblatt | Maintains | Buy | $174.00 | $174.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Live Nation Entertainment. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Live Nation Entertainment compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Live Nation Entertainment's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Live Nation Entertainment's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Live Nation Entertainment analyst ratings.

Discovering Live Nation Entertainment: A Closer Look

Live Nation is the largest live entertainment company in the world, serving as a concert promoter, venue operator, and ticketing platform. In addition, the firm generates revenue from sponsorships and advertising. With offices in 45 countries, Live Nation promotes concerts globally and it owns, operates, or had exclusive booking rights to nearly 400 venues worldwide at the end of 2024, which the firm says makes it the second-largest operator of music venues globally. In 2024, Live Nation promoted nearly 55,000 events, drawing more than 150 million fans. Ticketmaster is a dominant global ticketing service, selling almost 640 million tickets in 2024.

Live Nation Entertainment's Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Negative Revenue Trend: Examining Live Nation Entertainment's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -10.99% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Communication Services sector.

Net Margin: Live Nation Entertainment's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -2.21%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -53.64%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Live Nation Entertainment's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -0.36%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 78.25, caution is advised due to increased financial risk.

Analyst Ratings: Simplified

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.