The Analyst Verdict: Monday.Com In The Eyes Of 16 Experts

In the latest quarter, 16 analysts provided ratings for Monday.Com (NASDAQ:MNDY), showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 9 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 4 | 7 | 1 | 0 | 0 |

| 3M Ago | 2 | 1 | 0 | 0 | 0 |

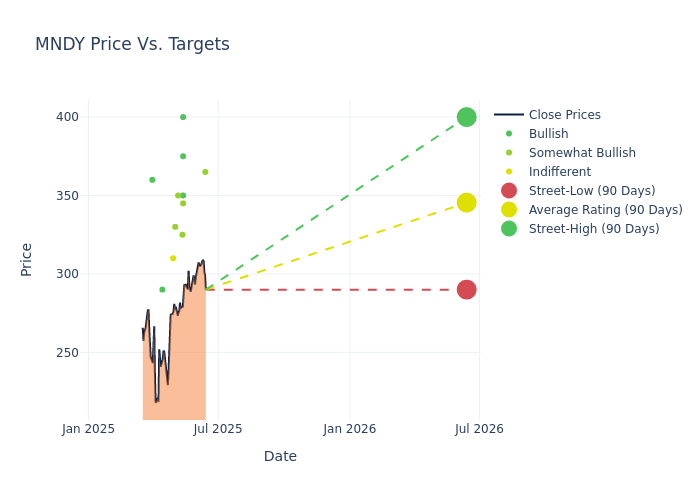

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $338.44, along with a high estimate of $400.00 and a low estimate of $290.00. Observing a downward trend, the current average is 6.64% lower than the prior average price target of $362.50.

Understanding Analyst Ratings: A Comprehensive Breakdown

The perception of Monday.Com by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Berg | Wells Fargo | Raises | Overweight | $365.00 | $335.00 |

| Michael Berg | Wells Fargo | Raises | Overweight | $335.00 | $310.00 |

| Mark Schappel | Loop Capital | Lowers | Buy | $375.00 | $385.00 |

| Raimo Lenschow | Barclays | Lowers | Overweight | $345.00 | $360.00 |

| David Hynes | Canaccord Genuity | Lowers | Buy | $350.00 | $375.00 |

| Scott Berg | Needham | Maintains | Buy | $400.00 | $400.00 |

| Brent Bracelin | Piper Sandler | Raises | Overweight | $325.00 | $305.00 |

| Pinjalim Bora | JP Morgan | Lowers | Overweight | $350.00 | $400.00 |

| Allan Verkhovski | Scotiabank | Raises | Sector Outperform | $330.00 | $315.00 |

| Taylor McGinnis | UBS | Lowers | Neutral | $310.00 | $350.00 |

| Brent Bracelin | Piper Sandler | Lowers | Overweight | $305.00 | $385.00 |

| Michael Berg | Wells Fargo | Lowers | Overweight | $310.00 | $380.00 |

| Lucky Schreiner | DA Davidson | Lowers | Buy | $290.00 | $350.00 |

| Brent Thill | Jefferies | Lowers | Buy | $360.00 | $400.00 |

| Allan Verkhovski | Scotiabank | Lowers | Sector Outperform | $315.00 | $400.00 |

| Lucky Schreiner | DA Davidson | Maintains | Buy | $350.00 | $350.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Monday.Com. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Monday.Com compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Monday.Com's stock. This analysis reveals shifts in analysts' expectations over time.

To gain a panoramic view of Monday.Com's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Monday.Com analyst ratings.

Unveiling the Story Behind Monday.Com

Monday.com is a provider of work management software delivered via a cloud-based software-as-a-service, or SaaS model. The firm's solutions offer flexible and highly customizable tools to digitize business processes across countless use cases. Monday's offering supports workflow management across departments, real-time visibility and accountability, and automation capabilities. Monday also offers prepackaged CRM and DevOps management solutions, in addition to standalone survey and digital whiteboard tools. As of 2023, Monday served over 225,000 customers in more than 200 countries.

Monday.Com's Economic Impact: An Analysis

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Monday.Com's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 30.12%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Monday.Com's net margin is impressive, surpassing industry averages. With a net margin of 9.72%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.57%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Monday.Com's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.55% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Monday.Com's debt-to-equity ratio is below the industry average. With a ratio of 0.11, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.