What Analysts Are Saying About Allegro Microsystems Stock

In the last three months, 8 analysts have published ratings on Allegro Microsystems (NASDAQ:ALGM), offering a diverse range of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 3 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

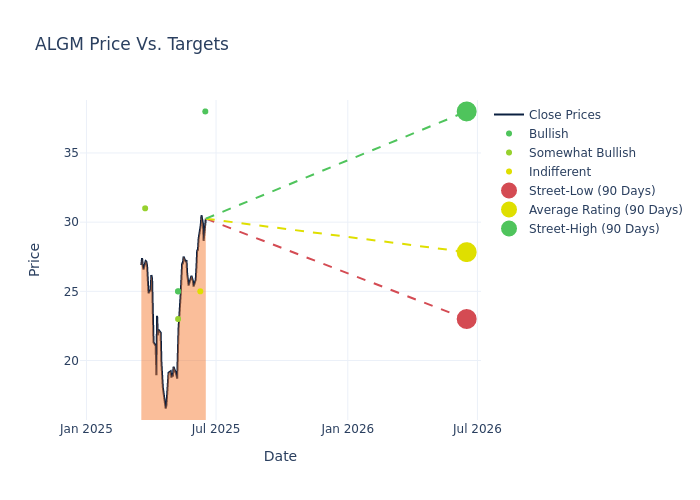

In the assessment of 12-month price targets, analysts unveil insights for Allegro Microsystems, presenting an average target of $26.38, a high estimate of $38.00, and a low estimate of $22.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 0.19%.

Analyzing Analyst Ratings: A Detailed Breakdown

The perception of Allegro Microsystems by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Vivek Arya | B of A Securities | Announces | Buy | $38.00 | - |

| Joseph Moore | Morgan Stanley | Raises | Equal-Weight | $25.00 | $23.00 |

| Timothy Arcuri | UBS | Raises | Buy | $25.00 | $22.00 |

| Blayne Curtis | Barclays | Raises | Overweight | $23.00 | $22.00 |

| Quinn Bolton | Needham | Lowers | Buy | $25.00 | $30.00 |

| Timothy Arcuri | UBS | Lowers | Buy | $22.00 | $30.00 |

| Blayne Curtis | Barclays | Lowers | Overweight | $22.00 | $30.00 |

| Vijay Rakesh | Mizuho | Raises | Outperform | $31.00 | $28.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Allegro Microsystems. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Allegro Microsystems compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Allegro Microsystems's stock. This examination reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Allegro Microsystems's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Allegro Microsystems analyst ratings.

Get to Know Allegro Microsystems Better

Allegro Microsystems Inc is a designer, developer, fabless manufacturer, and marketer of sensor ICs and application-specific analog power ICs for automotive and industrial markets. Its Sensor IC allows customers to precisely measure motion, speed, position, and current, and Power ICs include high-temperature and high-voltage capable motor drivers, power management, and LED driver ICs. Its products are divided into three categories such as SENSE which includes Current Sensors, Switches and Latches, and Interface ICs among others; REGULATE which includes Regulators, ClearPower Modules, and LED Drivers; and DRIVE which includes BLDC Drivers, Brush DC, and others. Key revenue for the company is generated from Greater China and the rest from the United States, Japan, Europe, and other regions.

Key Indicators: Allegro Microsystems's Financial Health

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Challenges: Allegro Microsystems's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -19.85%. This indicates a decrease in top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -7.68%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Allegro Microsystems's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -1.59%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Allegro Microsystems's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -1.03%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.4, caution is advised due to increased financial risk.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.