What 10 Analyst Ratings Have To Say About Winnebago Industries

Ratings for Winnebago Industries (NYSE:WGO) were provided by 10 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 4 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 2 | 1 | 0 | 0 |

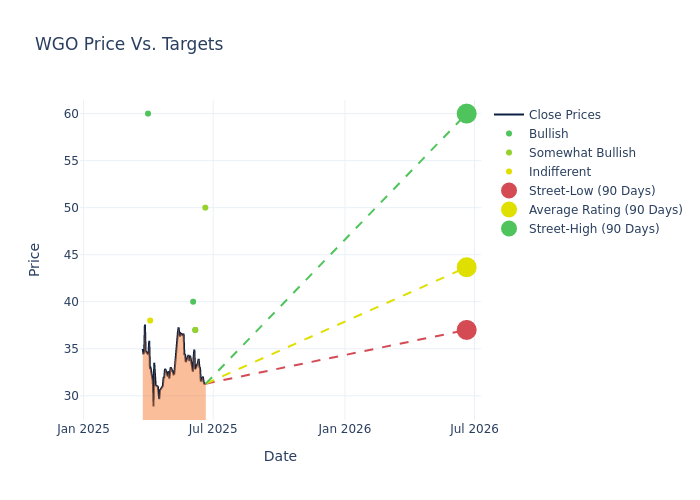

The 12-month price targets, analyzed by analysts, offer insights with an average target of $45.0, a high estimate of $60.00, and a low estimate of $37.00. Observing a downward trend, the current average is 13.29% lower than the prior average price target of $51.90.

Deciphering Analyst Ratings: An In-Depth Analysis

In examining recent analyst actions, we gain insights into how financial experts perceive Winnebago Industries. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tristan Thomas-Martin | BMO Capital | Lowers | Outperform | $50.00 | $60.00 |

| James Hardiman | Citigroup | Raises | Buy | $37.00 | $36.00 |

| Noah Zatzkin | Keybanc | Lowers | Overweight | $37.00 | $40.00 |

| Michael Swartz | Truist Securities | Raises | Buy | $40.00 | $38.00 |

| Eric Heath | Keybanc | Lowers | Overweight | $40.00 | $47.00 |

| Michael Swartz | Truist Securities | Lowers | Buy | $38.00 | $50.00 |

| Craig Kennison | Baird | Lowers | Neutral | $38.00 | $50.00 |

| Michael Albanese | Benchmark | Lowers | Buy | $60.00 | $70.00 |

| Michael Swartz | Truist Securities | Lowers | Buy | $50.00 | $58.00 |

| Tristan Thomas-Martin | BMO Capital | Lowers | Outperform | $60.00 | $70.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Winnebago Industries. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Winnebago Industries compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Winnebago Industries's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Winnebago Industries's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Winnebago Industries analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Winnebago Industries

Winnebago Industries manufactures Class A, B, and C motor homes along with towables, customized specialty vehicles, boats, and parts. Headquartered in Eden Prairie, Minnesota, Winnebago has been producing recreational vehicles since 1958. Revenue was nearly $3 billion in fiscal 2024. Winnebago expanded into towables in 2011 with the acquisition of SunnyBrook and acquired Grand Design in November 2016. Towables made up 83% of the firm's RV unit volume, up from 31% in fiscal 2016. The company's total RV unit volume was 38,796 in fiscal 2024. Winnebago expanded into boating in 2018 with the purchase of Chris-Craft, bought premium motor home maker Newmar in November 2019, and bought Barletta pontoon boats in August 2021. It also is developing electric and autonomous technology.

Breaking Down Winnebago Industries's Financial Performance

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Challenges: Winnebago Industries's revenue growth over 3M faced difficulties. As of 28 February, 2025, the company experienced a decline of approximately -11.85%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -0.06%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Winnebago Industries's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -0.03% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Winnebago Industries's ROA excels beyond industry benchmarks, reaching -0.02%. This signifies efficient management of assets and strong financial health.

Debt Management: Winnebago Industries's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.53.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.