14 Analysts Have This To Say About Emerson Electric

14 analysts have shared their evaluations of Emerson Electric (NYSE:EMR) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 4 | 3 | 3 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 1 | 1 | 0 |

| 2M Ago | 1 | 3 | 0 | 1 | 0 |

| 3M Ago | 2 | 1 | 1 | 1 | 0 |

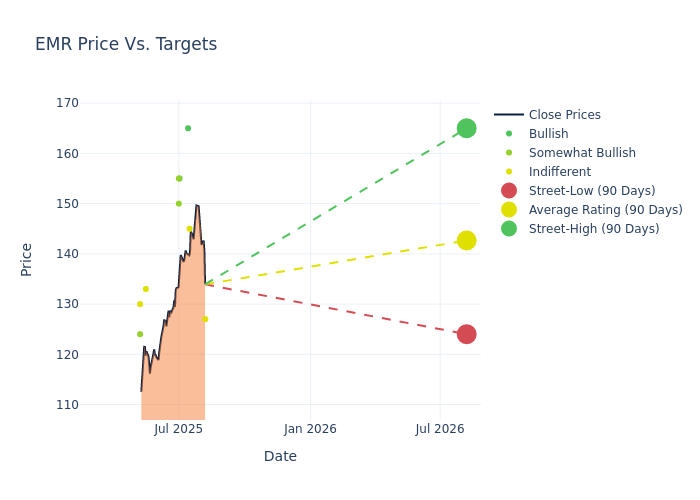

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $139.21, along with a high estimate of $165.00 and a low estimate of $112.00. This current average has increased by 10.17% from the previous average price target of $126.36.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Emerson Electric is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Julian Mitchell | Barclays | Raises | Equal-Weight | $127.00 | $125.00 |

| Tommy Moll | Stephens & Co. | Raises | Equal-Weight | $145.00 | $130.00 |

| Andrew Kaplowitz | Citigroup | Raises | Buy | $165.00 | $146.00 |

| Julian Mitchell | Barclays | Raises | Underweight | $125.00 | $118.00 |

| Andrew Obin | B of A Securities | Raises | Buy | $155.00 | $130.00 |

| Joseph O'Dea | Wells Fargo | Raises | Overweight | $150.00 | $135.00 |

| Ken Newman | Keybanc | Raises | Overweight | $155.00 | $150.00 |

| Ken Newman | Keybanc | Raises | Overweight | $150.00 | $125.00 |

| Julian Mitchell | Barclays | Raises | Underweight | $118.00 | $112.00 |

| Andrew Kaplowitz | Citigroup | Raises | Buy | $146.00 | $133.00 |

| Julian Mitchell | Barclays | Raises | Underweight | $112.00 | $104.00 |

| Joseph O'Dea | Wells Fargo | Raises | Overweight | $135.00 | $121.00 |

| Stephen Tusa | JP Morgan | Raises | Neutral | $133.00 | $113.00 |

| Andrew Kaplowitz | Citigroup | Raises | Buy | $133.00 | $127.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Emerson Electric. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Emerson Electric compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Emerson Electric's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Emerson Electric's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Emerson Electric analyst ratings.

All You Need to Know About Emerson Electric

Founded in 1890 as the first manufacturer of electric fans in North America, Emerson Electric has become a leading industrial automation player through the acquisition of established brands. Emerson organizes its business into seven segments that sell a wide range of automation software, power tools, and automation hardware such as valves, gauges, and switches. In recent years, Emerson divested its climate technology and consumer businesses to become more of a pure-play industrial automation company. The automation of a factory is an enticing long-term proposition for manufacturers, helping reduce accident rates and raise uptime and productivity.

Financial Milestones: Emerson Electric's Journey

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Emerson Electric's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 1.28%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: Emerson Electric's net margin excels beyond industry benchmarks, reaching 10.94%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Emerson Electric's ROE excels beyond industry benchmarks, reaching 2.44%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Emerson Electric's ROA stands out, surpassing industry averages. With an impressive ROA of 1.15%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Emerson Electric's debt-to-equity ratio surpasses industry norms, standing at 0.77. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Core of Analyst Ratings: What Every Investor Should Know

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.